XRP Price Prediction: Can XRP Hit $4 Amid Bullish Momentum?

#XRP

- Technical Strength: Price above MA + MACD crossover signals bullish momentum.

- Legal Tailwinds: SEC exemptions and partnerships reduce regulatory uncertainty.

- Institutional Demand: VivoPower's $100M investment highlights growing institutional interest.

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge

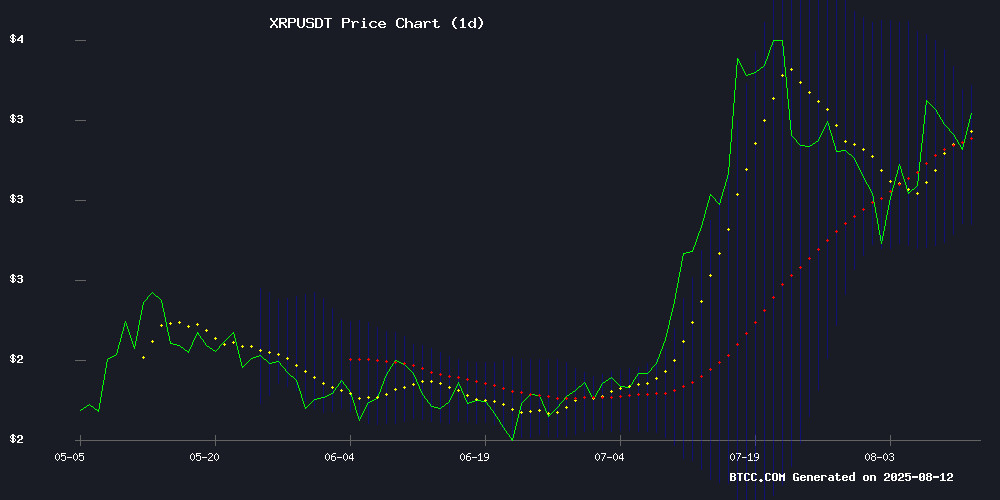

XRP is currently trading at 3.1536 USDT, above its 20-day moving average (3.1034), indicating a bullish trend. The MACD shows a positive crossover (0.1051 > 0.0955), reinforcing upward momentum. Bollinger Bands suggest volatility, with the price NEAR the upper band (3.3595), hinting at potential further gains if the trend holds.

XRP Market Sentiment: Legal Wins Fuel Optimism

Recent news highlights Ripple's legal victories and strategic partnerships, including a $100M investment from VivoPower and Western Union's acquisition of an ODL partner. These developments are likely to bolster investor confidence and drive demand for XRP, aligning with the bullish technical outlook.

Factors Influencing XRP’s Price

Ripple vs SEC Legal Dispute Sparks Confusion Over Case Closure

The prolonged legal battle between Ripple Labs and the U.S. Securities and Exchange Commission has entered a contentious new phase. Recent claims of case dismissal triggered viral speculation across crypto communities, but legal experts remain divided on interpretation.

Federal appellate procedures allow stipulated dismissals without judicial approval under FRAP 42(b), a nuance fueling debate. While some analysts declare the matter resolved, others caution against premature conclusions in this landmark securities case.

Market participants continue scrutinizing every development, as the outcome carries significant implications for XRP's regulatory standing. The dispute highlights growing tensions between crypto innovation and securities compliance frameworks.

XRP Price Prediction For August 12: Mixed Signals Amid Short-Term Rally

XRP's price action presents a paradox. While the token has shown short-term strength with a recent bounce, the weekly chart reveals a bearish divergence—a classic warning sign of slowing momentum. This technical pattern typically precedes pullbacks, suggesting potential weakness in the coming months.

The daily chart echoes January-February 2023's false rally, where temporary gains ultimately gave way to broader declines. Current support at $3.10-$3.15 faces mounting pressure, with a breakdown risking tests of $2.90 and potentially $2.55-$2.62—a make-or-break zone for long-term holders.

Resistance remains formidable near $3.35-$3.40, where repeated rejections have solidified this barrier. Market technicians note that late August through October could see intensified selling pressure, mirroring bearish patterns across correlated assets.

SEC Grants Ripple Exemption for Securities Sales, Igniting Legal Debate

The U.S. Securities and Exchange Commission (SEC) has issued a surprising exemption allowing Ripple to sell securities to private investors, sidestepping prior rulings by Judge Torres in the XRP case. Legal experts are divided, with some questioning the lack of recourse to challenge the decision while others see it as a pragmatic move.

Ripple gains a new revenue stream, but the exemption has raised eyebrows over potential preferential treatment. The SEC's unconventional approach—citing "current conditions" as justification—contrasts with its usual enforcement rigor. Meanwhile, the broader crypto industry watches closely, as the ruling may signal shifting regulatory priorities.

Ripple (XRP) Regains Momentum After Legal Victory, Sparking Market Interest

Ripple's XRP token surged to $0.72 following a pivotal court ruling that rejected the SEC's claim that XRP constitutes a security. This regulatory clarity has reignited interest among both retail and institutional investors, marking a potential turning point for the token's adoption.

While some traders chase short-term gains, others are leveraging cloud mining platforms like AIXA Miner to generate consistent XRP-denominated yields without direct market exposure. The platform's automated contracts offer daily payouts, insulating users from volatility while capitalizing on broader market growth.

The legal victory represents a watershed moment for cryptocurrency regulation, with implications extending beyond XRP. Major exchanges and financial institutions are reassessing their stance on the token, potentially accelerating its integration into banking and fintech infrastructure.

Ripple, Circle, and Paxos Drive Stablecoin Regulation Battle to the OCC

Major stablecoin issuers Ripple, Circle, and Paxos are racing to secure national trust bank charters with the Office of the Comptroller of the Currency (OCC) as U.S. regulatory scrutiny tightens. The move underscores a strategic pivot toward unified federal oversight and expanded market access amid growing competition.

Paxos, already regulated by the NYDFS since 2015, seeks to convert its state charter into a federal one. This would layer OCC supervision atop its existing global compliance framework, spanning Europe, Singapore, and Abu Dhabi. The firm emphasizes full reserve backing for all issued assets—a hallmark of its 2018 pioneering stablecoin launch.

Circle and Ripple join the fray, betting that OCC charters will streamline compliance and enhance credibility. The push coincides with legislative momentum around the GENIUS Act, which could reshape stablecoin governance. For these players, federal recognition isn’t just regulatory tidiness—it’s a competitive weapon in the battle for institutional adoption.

VivoPower Makes Historic $100M Investment in Ripple, Acquiring Equity and XRP Tokens

VivoPower International PLC has secured a landmark deal to purchase $100 million worth of Ripple Labs shares, becoming the first U.S.-listed company to hold both equity in the blockchain firm and its associated XRP tokens. The transaction grants VivoPower exposure to approximately 211 million XRP at an effective price of $0.47 per token—a strategic move to establish a low-cost position in the digital asset.

The two-month due diligence process culminated in definitive agreements with existing Ripple shareholders. Upon management approval, VivoPower will be recorded on Ripple's cap table with full legal title to the shares. This dual acquisition structure reflects growing institutional interest in cryptocurrency ecosystems beyond simple token holdings.

Market observers note the deal's timing coincides with renewed regulatory clarity for XRP following Ripple's partial legal victory against the SEC. The transaction may signal a new phase of corporate cryptocurrency adoption, where public companies seek combined equity and token exposure to blockchain innovators.

Coinbase Executes $53M XRP Transfer Between Internal Cold Wallets

Coinbase orchestrated a significant 16.7 million XRP transfer valued at $53.16 million between its internal cold storage wallets on Monday. Blockchain tracking services initially misinterpreted the movement as an external deposit before on-chain analysis revealed the transaction occurred between two institutional-grade reserve addresses.

The exchange's Wallet 197 redistributed the assets to Cold Wallet 6—both known components of Coinbase's deep custody infrastructure. Each vault typically maintains approximately 16.5 million XRP, suggesting this operation represents routine treasury management rather than market-facing activity.

Such large-scale internal movements underscore exchanges' operational complexity in safeguarding digital assets. The transaction's visibility through public blockchain tracking highlights the transparent yet often misinterpreted nature of institutional crypto operations.

Legal Expert Dismisses Speculation Over Final Ruling in XRP Case

Bill Morgan, a prominent lawyer and XRP advocate, has refuted claims that Judge Analisa Torres will issue a final decision in the XRP case today. The speculation, circulating on social media, suggested such a ruling could propel XRP to a $5 price target. Morgan labeled the claims as "deluded and wrong," emphasizing the case concluded last week after the SEC and Ripple withdrew their appeals.

The XRP case, which began in December 2020, drew global attention for its potential market implications. Judge Torres previously ruled that institutional sales of XRP violated securities laws, while exchange sales did not. With the withdrawal of appeals, no further rulings are expected, marking the end of the legal saga.

Western Union to Acquire Ripple ODL Partner Intermex in $500 Million Deal

Western Union has agreed to purchase Intermex, a key user of Ripple's On-Demand Liquidity (ODL) service, in a deal valued at $500 million. The acquisition grants Western Union direct access to Ripple's cross-border payment technology while expanding its retail footprint across North America and high-growth remittance corridors.

The cash transaction values Intermex at $16.00 per share, representing a 50% premium to recent trading levels. Expected to close by mid-2026, the deal combines Intermex's strong Latin American network with Western Union's global scale. Annual cost synergies of $30 million are projected within two years.

This strategic move signals growing institutional adoption of blockchain-based settlement solutions. Ripple's ODL technology, which utilizes XRP for liquidity, stands to gain broader exposure through Western Union's extensive payment infrastructure.

VivoPower to Acquire 211M XRP at 86% Discount in Strategic Crypto Move

Nasdaq-listed VivoPower International PLC has unveiled an ambitious crypto treasury strategy, centering on a $100 million acquisition of privately held Ripple shares. The solar energy firm will secure 211 million XRP tokens at a steep 86% discount to current market prices, pending board approval from Ripple.

The transaction represents a calculated bet on institutional crypto adoption, with VivoPower becoming the first U.S. public company offering combined exposure to Ripple equity and XRP holdings. At an effective price of $0.47 per token, the deal values the XRP position at $696 million—a significant premium to the purchase price.

Ripple's XRP reserves, originally mined in the genesis block, remain a focal point for market stability. The company's monthly release of 1 billion tokens provides predictable supply dynamics that VivoPower's treasury team appears to value strategically.

XRP Ledger Leads Real-World Asset Growth with 32% Monthly Surge

The XRP Ledger has outpaced all major blockchain networks in real-world asset (RWA) growth, posting a 32.27% monthly increase to reach $243.2 million in total value. This remarkable expansion stems primarily from Ripple's RLUSD stablecoin, which is accelerating settlement adoption on the network.

With just nine high-value listings, the ledger now ranks first in percentage growth ahead of Arbitrum and Plume. Phil Kwok of EasyA Labs describes the trajectory as "very impressive," noting RLUSD's pivotal role in driving activity. "What we're working on will send this skyrocketing," he added, signaling further momentum ahead.

Will XRP Price Hit 4?

Based on current technical indicators and positive market sentiment, XRP has strong potential to reach $4. Key factors include:

| Factor | Value | Implication |

|---|---|---|

| Price | 3.1536 USDT | Above 20-day MA (bullish) |

| MACD | 0.1051 > 0.0955 | Upward momentum |

| Bollinger Bands | Near upper band (3.3595) | Volatility with upside bias |

Legal clarity and institutional interest further support this target.